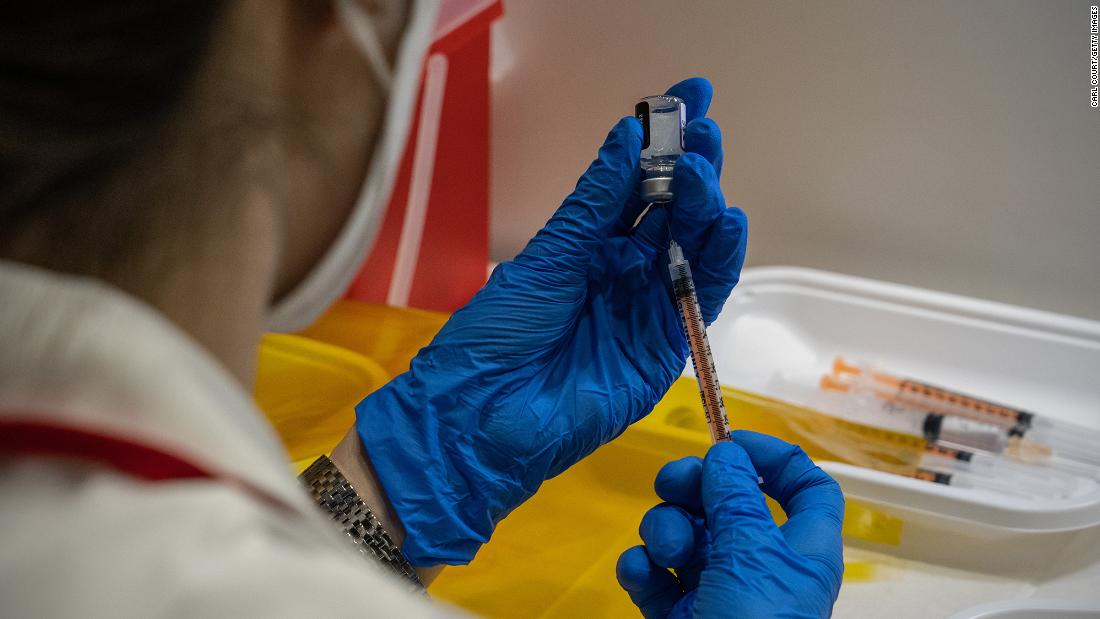

New York (CNN Business)Pfizer's sales in the fourth quarter more than doubled, thanks to strong demand for its Covid-19 vaccine. But that wasn't good enough to satisfy investors.

The drugmaker said it posted revenue of $23.8 billion, missing Wall Street's expectations of $24.1 billion. More than half of Pfizer's total sales, $13.9 billion, came from its vaccines unit.

The company also reported net income of $3.4 billion, topping analysts' forecasts. Pfizer said it expects $32 billion in sales this year from Comirnaty, the Covid vaccine. Still, that was below Wall Street's expectations of nearly $34 billion. The company's overall sales and profit guidance for 2022 also missed consensus estimates.

Shares of Pfizer (PFE) fell nearly 3% on the news. The stock is down about 15% so far this year. Pfizer's stock, which was removed from the Dow in August 2020, surged 60% in 2021.

Shares of Pfizer's vaccine partner BioNTech (BNTX) were down more than 3% in early trading too. The stocks of rival vaccine makers Moderna (MRNA) and Novavax (NVAX) were also lower Tuesday. Johnson & Johnson (JNJ) and AstraZeneca (AZN) were flat.

Pfizer, along with BioNTech, applied for emergency-use authorization of its Covid-19 vaccine for kids under the age of 5 with the US Food and Drug Administration earlier this month. Pfizer has also developed an antiviral pill, called Paxlovid, that can be used to treat Covid-19 patients at home before they become seriously ill. The FDA approved Paxlovid in December. Pfizer said Tuesday it expects to generate $22 billion in sales from Paxlovid in 2022. Analysts were expecting revenue of nearly $23 billion.

"In the early days of the Covid-19 pandemic, we committed to use all of the resources and expertise we had at our disposal to help protect populations globally against this deadly virus, as well as to offer treatments to help avoid the worst outcomes when infections do occur," said Pfizer CEO Albert Bourla in the earnings release. "Now, less than two years since we made that commitment, we are proud to say that we have delivered both the first FDA-authorized vaccine against Covid-19 (with our partner, BioNTech) and the first FDA-authorized oral treatment for Covid-19."

During a conference call with analysts Tuesday, Bourla said that pricing for Paxlovid in high-income countries will be "more or less in line" with what rival Merck (MRK) is charging for its antiviral Covid pill, which has also been approved by several global regulators.

Typically, higher-income countries pay more for medications. But Bourla added that the US is getting "a very special price because of higher orders." Bourla also noted that Pfizer has begun working with generic companies to make lower-priced versions of Paxlovid, a deal that could cover more than half of the world's population.

Pfizer is continuing to develop other drugs too, of course. The company announced a nearly $7 billion acquisition in December of Arena Pharmaceuticals (ARNA), a company developing drugs to treat immuno-inflammatory diseases. That deal came just a month after Pfizer completed a more than $2 billion purchase of cancer drug maker Trillium Therapeutics.

Bourla is hoping that Pfizer will remain innovative.

During prepared remarks for the analyst conference call, Bourla said "colleagues across Pfizer are inspired by what we have achieved and more determined than ever to be part of the next potentially game-changing breakthrough."

"To that end, we are applying the 'lightspeed' principles developed for our Covid-19 work to our other therapeutic areas to make sure we continue to move at the speed of science for the benefit of patients," he added.

Covid vaccine gives Pfizer sales and profits a big boost - CNN

Read More

No comments:

Post a Comment