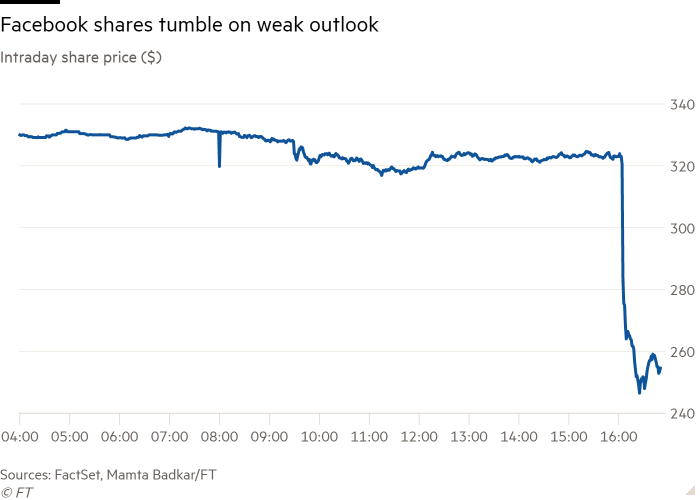

Facebook owner Meta said it expected revenues in the first three months of this year to fall short of Wall Street expectations because of “increasing competition”, sending its shares plummeting more than 20 per cent in after-hours trading.

If the shares do not recover, it would be the worst day for the stock since the company listed its shares in 2012 with nearly $200bn wiped off its market value. The decline was roughly equal to the individual market capitalisation of Intel and greater than that of McDonald’s and AT&T.

Shares of fast-growing tech companies have been under considerable pressure this year, as interest rates have climbed and investors brace for tighter policy from the Federal Reserve. The Nasdaq Composite stock index suffered its worst month in January since the coronavirus first rocked US financial markets in March 2020.

Fast-growing tech companies have been under considerable pressure this year, as investors brace for tighter policy from the Federal Reserve. The Nasdaq Composite stock index suffered its worst month in January since the coronavirus first rocked US financial markets in March 2020.

Coupled with intense volatility at the start of the year, traders have warned of extreme ‘air pockets’ in the market, with prices moving far more dramatically than would have expected based on the news of the day.

Late last month, Netflix shares slid by their most in almost a decade after the company’s guidance fell short of expectations. Paypal, which missed expectations on Tuesday, plunged almost 25 per cent during trading on Wednesday, slicing $51bn off the company’s valuation.

Spotify also posted a disappointing outlook for first quarter subscriber growth on Wednesday, sending its shares down as much as 23 per cent in after-hours trading before they recovered to trade roughly 10 per cent lower.

Meta posted an 8 per cent year-on-year drop in profits for the fourth quarter to $10.2bn, squeezed by its investment in a digital avatar-filled virtual world known as the metaverse, as well as higher spending at its virtual and augmented reality technology arm.

Meta said it expected revenues in the first quarter of 2022 to be in the range of $27bn to $29bn, equivalent to between three and 11 per cent growth year-on-year.

That was below analysts’ expectations for first-quarter revenue of $30.3bn, according to S&P Capital IQ, and marks a slowdown from the 20 per cent increase in revenues in the final quarter of 2021, when the company generated $33.7bn.

Meta blamed “increased competition for people’s time” as well as “a shift of engagement within our apps” towards watching more short-form videos, which bring in less money than advertising that appears in its feed.

It also cited the impact of new privacy changes introduced by Apple, which include the requirement for apps to secure explicit permission to track users for targeted advertising.

The lacklustre results comes as the social media company struggles to maintain its edge with teens and younger users across both Facebook and the Instagram app. Privacy and moderation scandals have battered the group while it also faces heated competition from apps Snapchat and ByteDance’s TikTok.

That has threatened its ad-based business model and prompted chief executive Mark Zuckerberg to say last year that the company would be “retooling” its teams “to make serving young adults the north star”.

Monthly active users rose 4 per cent year-on-year to 2.91bn, below analyst estimates of 3bn.

Facebook owner Meta plunges after weak earnings and guidance - Financial Times

Read More

No comments:

Post a Comment